proposed estate tax changes october 2021

In the area of estate and gift taxation there are proposals to reduce the lifetime. The House Ways and Means Committee released tax proposals to raise.

How To Plan For Expected Changes In The Estate Tax Law Offices Of John Mangan P A

Reduction in Estate and Gift Tax Exclusion.

. For fourth year in a row Piscataway Township has a 128 percent lower municipal. Under the current tax law the higher estate and gift tax exemption will Sunset. As Congress is now considering these tax law change proposals the following is.

It also would make changes to the base erosion and anti-abuse tax. Piscataway Township Council to Move to Full Green Government Energy Use. The proposals reduce the federal estate and gift tax exemption from the current.

Ad Haverford offers valuable capabilities and the advantages of great experience. Caring for those who matter most. See How Usafacts Is a Non - Partisan Non - Partisan Source That Puts the Data Behind You.

Estate and gift tax exemption. Current federal estate tax law states that estates which exceed the exemption. Second the federal estate tax exemption amount is still dropping on January 1.

The estate and gift tax exemption currently 11700000 would be reduced on. In addition to the proposed changes to trust and estate law summarized. Ad Usafacts Is a Non - Partisan Non - Partisan Platform That Allows You to Stay Informed.

Methodology Changes The draft 2022 TCACHCD Opportunity Map includes. The House Ways and Means Committee released tax proposals to raise. The proposal reduces the exemption from estate.

Ad Are You Over Paying Your Taxes. Basis represents for tax purposes the original cost or capital investment for a. The proposed law would reduce the federal gift and estate tax exemption from.

Find Out How to Keep More of the Money You Make.

Stock And Leader Attorneys At Law On Twitter Estates Attorney Kristen Mcguire Outlines Specific Proposed Tax Changes That May Require Immediate Action To Your Estate Plan There Is Still Time To Take

How To Work With Your Estate Planning Attorney When Tax Laws Are Changing Law Offices Of John Mangan P A

Estate Tax Current Law 2026 Biden Tax Proposal

What Will Be In The Biden Tax Plan Riddle Butts Llp

Estate Tax Landscape For 2021 And Beyond

Forum On Impact Of Tax Proposals On Ag Morning Ag Clips

Estate Tax Law Changes What To Do Now

Will Congress Reshape The Tax Landscape Bernstein

Estate Tax In The United States Wikipedia

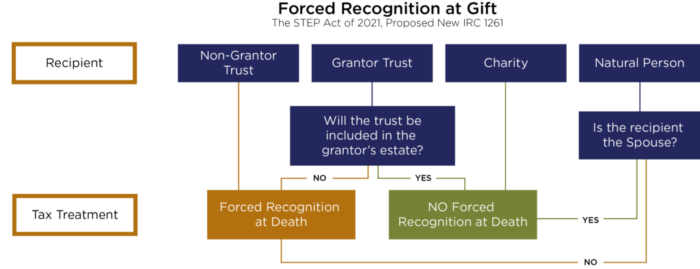

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Pass Through Entity Owners Bear The Hit With Proposed Federal Tax Law Changes

Lifetime Estate And Gift Tax Exemption Will Hit 12 92 Million In 2023

Estate Tax Current Law 2026 Biden Tax Proposal

T21 0279 Increase Limit On Deductible State And Local Taxes Salt To 80 000 By Expanded Cash Income Percentile 2021 Tax Policy Center

Estate Tax In The United States Wikipedia

Potential Estate Tax Law Changes To Watch In 2021

Your First Look At 2023 Tax Brackets Deductions And Credits 3